.jpg)

Form 1099 Requirements Explained

General Rules

- A Form 1099 needs to be issued and sent to all sole proprietors, independent contractors, partnerships, and LLCs1 that you paid for services exceeding $600, including rent, interest, dividends, and royalties. The IRS has rules to decide if a worker is an employee or a contractor. For assistance in classifying your workers, check with the IRS here.

- Vendors that are incorporated are exempt.

- Attorneys and medical services are always subject to 1099 requirements, even if they are incorporated.

- Form W9 - During the year, whenever a check is issued for any of the above that requires the issuance of Form 1099, make sure you obtain a completed and signed Form W-9 to be kept with your files.

- Services performed outside of the U.S. - Generally, if the services are performed entirely outside the U.S., and the contractor is not a U.S. person, you do not need to report their payment on Form 1099-NEC. The form W-8BEN should be used instead and kept on file.

- Backup Withholding - If a payee refuses to provide you with the information required, or if the IRS notifies you that the Tax ID does not match, you may be obligated to deduct 24% withholding tax.

- Third-Party Payment & Form 1099-K - You are not required to send a 1099 if you paid a contractor via third-party payment networks like your credit card processor, PayPal Business, or Stripe. Instead, the payment settlement entities (PCEs), such as your credit card companies and other third-party payment companies will handle any required reporting and issue a form called the 1099-K, as required.

- If you pay business expenses via PayPal's Friends and Family option, you will need to issue a 1099-NEC to them. When you use this method to transfer funds, PayPal assumes that it is a non-business transaction and doesn't include it in their 1099-K.

- The same applied to Zelle payments.

- Employees bonuses and 1099 Rules - Bonuses or commissions to your employees should be included in their regular paychecks, not as a separate 1099 payment. If an employee performs an unrelated job, they should receive both a Form W-2 for their regular employment and a Form 1099 for a separate, unrelated job.

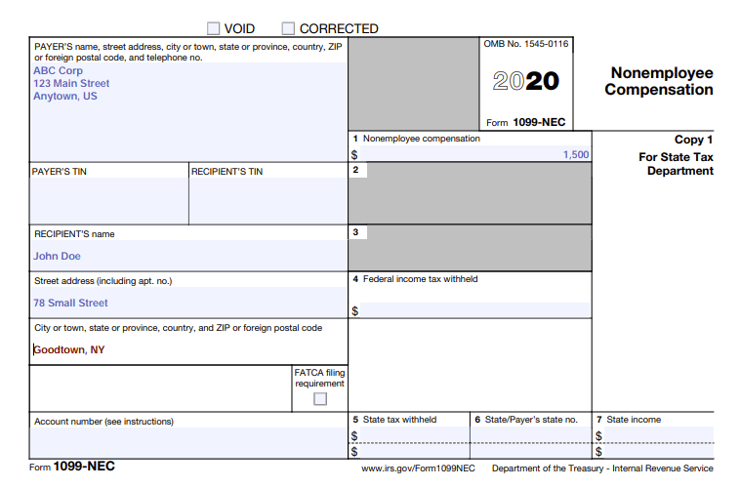

1099-MISC vs. 1099-NEC

- Form 1099-NEC - Use for all subcontractor and nonemployee compensation, including payments to attorneys for services, reported in Box 1,

- 🗓️ The due date to issue the form to the recipient is January 31, 2026.

- 🗓️ The due date to file with the IRS is also January 31, 2026.

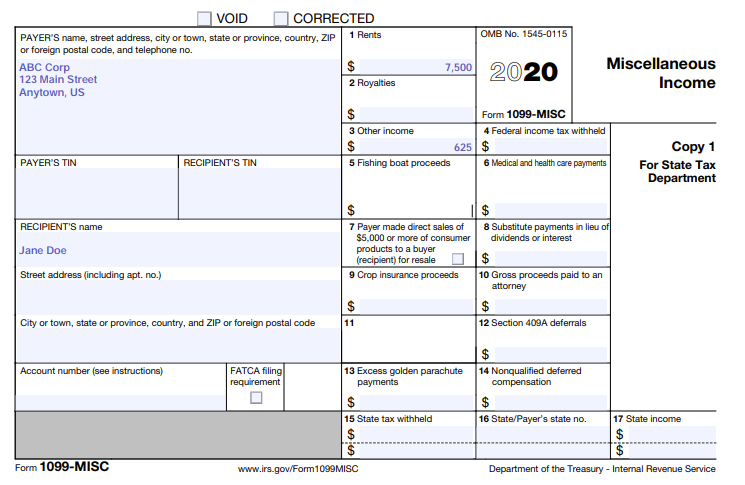

- Form 1099-Misc. - Should be used for other payments such as rent payments.

- 🗓️ The due date to issue the form to the recipient is February 2, 2026.

- 🗓️ The due date to e-file with the IRS is generally March 31, 2026.

.jpg?width=2807&height=1871&name=shutterstock_592298078%20(1).jpg)

The following information is needed to prepare the forms:

- Name of the business, in the case of an individual, the first and last name.

- Tax ID or Social Security Number

- Address

- Amount paid throughout the year

Filing Your 1099 Forms

Now that you have the fundamental understanding of filing 1099, you are ready to file! You can take one of the following 4 approaches.

- Consult A Professional: Contact your payroll provider or accountant and have them file it for you.

- Direct E-filing: You have the option to e-file the forms directly with the IRS at no cost. The IRS offers this service through its IRIS program. (Does not support state filings)

- Use Specialized Apps: Use a third-party app such as Track1099. These apps facilitate both the filing and issuing of 1099 forms. (supports state filings and corrections)

- Leverage Accounting Software: If you’re a QuickBooks user, you can process your 1099 forms directly within the software. (Does not support state filings or corrections)

⚠️ Note of caution:

-

Tax return declarations: All federal business tax returns (1120, 1120S, 1065, Schedule C, etc.) contain specific questions related to Form 1099. These questions inquire whether any payments were made that would necessitate the filing of Form 1099 and whether all required Form 1099 were filed.

-

Legal implications when signing your tax return: By signing your tax return, you declare—under penalties of perjury—that to the best of your knowledge and belief, your tax return is accurate and complete. If all Forms 1099 are not filed, you could be held liable in the event of an IRS audit. That's why it is becoming more and more important that you comply with all 1099 reporting requirements.

-

Penalties for non-compliance: The IRS also dramatically increased the penalty for failure to comply or for issuing Forms 1099 late.

Reach out to your payroll provider or accountant to prepare your 1099 Forms.

Form 1099-NEC

1099-MISC

Notice how Box 7 has been changed.

❓ Looking to learn more about employee payroll updates? Check out this article.

1 Generally, LLCs that elect to be treated as C or S Corps are exempt.