Here is a basic guide on what you need to know about EIDL repayments, when they start, and how to set them up.

Some Important Points

- The 30 months repayment starts from the original date of the loan, irrespective if you applied and were granted subsequent increases at a later date.

- Although the SBA granted the postponement of repayment for two and a half years, interest on the loan started to accrue from the original disbursement date. This deferment resulted in larger monthly payments.

Where can I see my current open balance?

- Create an SBA Lending Account

|

⚠️You will need your loan number (not to be confused with the application number) in order to create the account.

💡Can't locate your original EIDL loan number? Use your PPP loan number instead.

|

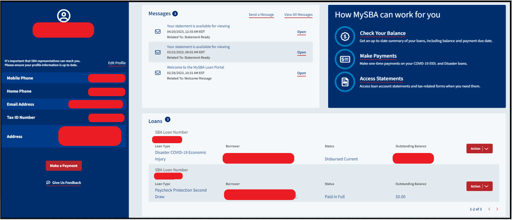

- Once your account has been set up, you'll find a list of all your SBA loans.

Where can I set up a one-time payment or set up autopay?

- Select Action on the right side of the loan and click on Make Payment

- Although you are permitted to remit payment via mail, we strongly encourage you to pay through the SBA Lending site.

- We encourage you to set up monthly auto payments, ensuring you don’t miss a payment.

- There is no prepayment penalty, so making early payments can help you save on interest fees.

How do I allocate the monthly payments, and how do I amortize them?

- Keep in mind that because of the fact that the loan payment was deferred for two years, the payments are going 100% toward the interest since there has been two years' worth of interest accrued. Therefore, we removed the amortization schedule for the 2022 tax filing season. We will update the amortization schedule for the 2023 tax filing season.

- Based on item A, if you make the minimum payments, it will take a long time to get to the point where you are making a dent in the principal. We therefore recommend increasing your monthly payment to payoff the accrued interest and start paying down the principal.

We know that this is a lot of information to digest, so if you have any further questions, please post them below.